“Crypto Secrets Revealed: A Beginner’s Guide to IDOs, Profits, and Candlestick Charting”

The cryptocurrency world has grown rapidly in recent years, with new investors entering the market every day. For those who have entered this vast ecosystem, there are a few key strategies that can help you maximize your profits and stay ahead.

IDO: The Initial Coin Offering Market

One popular strategy among cryptocurrency investors is the IDO (Initial Coin Offering) market. IDO refers to the launch of an Initial Coin Offering on an existing exchange or platform. It allows early adopters of a new project to get in on the ground floor and potentially reap huge rewards.

IDO platforms typically offer unique advantages, including:

- Early access to a limited number of tokens

- Higher return potential due to increased demand

- Reduced risk due to lower market volatility

However, IDOs can also be volatile, as prices fluctuate rapidly during the initial token allocation. Successful investors must be prepared to buy at the right time and sell at the peak.

Profit: The Key to Success

Profit margins are key to the success of any investment strategy, including IDOs. Here are some tips to maximize profits:

- Diversification

: Spread your investments across a variety of assets to reduce risk.

- Set clear goals: Identify what you want to achieve with your investments and stick to them.

- Stay informed: Follow market news and trends so you can make informed decisions.

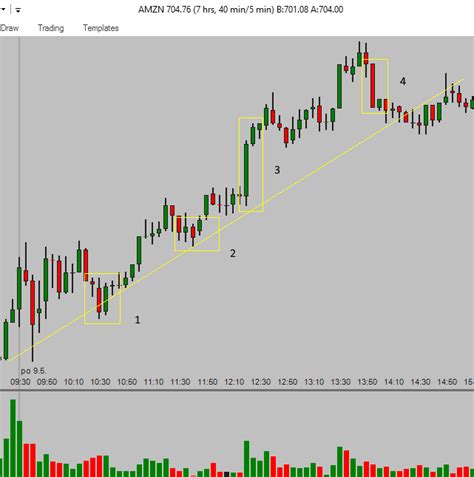

Candlestick Chart: A Visual Guide to Market Analysis

A candlestick chart is a visual representation of price movements in financial markets. It is a powerful tool for traders and investors, providing insights into market sentiment and trend direction.

Here are some of the key features of a candlestick chart:

- Bar Height

: A vertical line connecting two consecutive peaks or troughs, indicating the high and low price of an instrument.

- Body Length: The horizontal bar between the wicks indicates a price range, with the tail at the lower end indicating lower prices and the head at the upper end indicating higher prices.

Using Candlestick Charts in the Crypto Environment

Candlestick charts can be particularly useful in the cryptocurrency markets:

- Identify Trends: Look for consistent price movement, such as a clear uptrend or downtrend.

- Support and Resistance Detection: Identify support areas (where prices tend to bounce) and resistance areas (where prices tend to break through).

- Determining Trading Strategies: Use candlestick charts to identify buy and sell signals based on specific price levels.

Conclusion

Investing in cryptocurrency can be a high-risk, high-reward proposition. To maximize your profits and stay ahead of the curve, it is essential to understand the ICO market and profit margins, as well as use visual tools like candlestick charts to analyze market trends. If you combine these strategies with a clear understanding of each of them, you will be well prepared to unlock the secrets of cryptocurrency investing.