P2P Cryptocurrency Transactions: Tips for New Users

As the world of cryptocurrency continues to develop, many new users are eager to explore the potential of peer nets (P2P) events. But before diving into the world of decentralized funding (defi), it is necessary to understand how P2P events work and what you need to know.

What is the P2P cryptocurrency shop?

The P2P event, also known as “cross chain” or “block chain blockchain”, allows users to send encryption currency from one blockchain network to another. This process enables the creation of new funds, such as the cough and stablecin, by utilizing the protocols behind both networks.

P2P cryptocurrency stores

There are several types of P2P events:

- Cross transfers of the chain : Sending encryption castings from one blockchain to another.

- Distributed Financing (Defi) Swaps : Changing alternatives between different Defi platforms such as borrowing and borrowing.

- Compatibility : Integration of different Blockchain networks into seamless borders.

P2P Currency Trade Key Players

Some of the significant players of the P2P cryptocurrency mode are:

- Ripple

: Known for its XRP ID, Ripple is a popular choice for defi events and inter-chain transfers.

- Tezos : Tezos is an open source platform that allows P2P events between different networks.

- Binance smart ring : Binance’s original cryptocurrency, BNB, has gained popularity as a decentralized Stablecoin.

tips for new users

To succeed in the world of P2P cryptocurrency stores, follow these tips:

- Explore and understand the Blockchain network with which you are : Explore your underlying protocol and its restrictions.

2

- Understand payments : P2P events can be expensive due to the cross-border nature of these functions. Be ready for higher charges compared to traditional chain transactions.

- Be careful for scams and phishing attempts : Protect yourself from counterfeit, wallets or investment systems by being alert and conducting thorough research before investing.

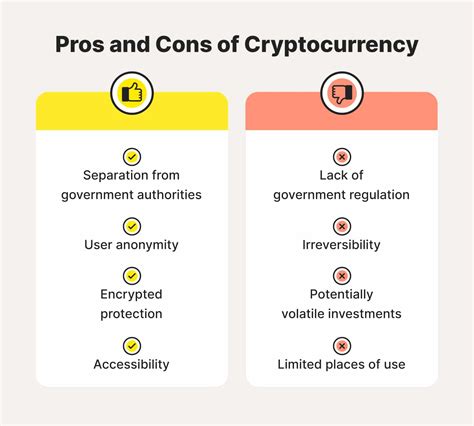

- Let’s look at your risk tolerance : P2P cryptocurrency trading is a high risk due to market volatility and regulatory uncertainty.

Best Practices for Safe P2P Currency Trade

To minimize risks and maximize return:

- Use reputable replacements and wallets : Make sure you use reliable platforms that meet regulatory requirements.

- Make sure the sender’s identity : Be careful when submitting funds from unknown persons or addresses.

- Keep private keys safe : Protect your wallet private keys to prevent unauthorized access.

4

conclusion

P2P cryptocurrency trades offer a promising new border in the world of decentralized funding (Defi). Understanding how these events work, choosing reliable platforms, and following the best practices, you can navigate in this complex mode. Remember to stay up -to -date with regulatory updates, market variations and safety threats to ensure safe and successful participation.

Disclaimer

This article is intended only for information purposes and should not be considered an investment advisor or recommended to participate in the P2P cryptocurrency trading. Always carry out thorough research and take experts before making investment decisions.